Voyo wants to create space for its services in the prepaid video market. “In order to make progress, we will have to double the number of subscribers every year,” says the Director of Digital Media of CME, Daniel Grunt.

Daniel Grunt has been managing internet activities of Central European Media Enterprises (CME) since this March. He has also taken responsibility for the digital direction of the local TV Nova. In an interview with Daniel Grunt, we discussed the priorities of TV Nova’s digital strategy for this year and the transformation of the strategy.

Let’s start with the tasks in your new role in CME and TV Nova. The position is rather broad, comprising all countries within the group and local online activities of the Nova group. What are you going to focus on this year?

I am in charge of all CME digital activities and as we want to make fast progress with the Voyo video portal, my attention will focus nearly exclusively on the Czech and Slovak markets in the first year. We see the development of Voyo as key. We have set an ambitious goal to achieve one million subscribers in the Czech Republic and Slovakia within five years. In addition, we want to move the TN.cz website closer to TV News. The third point on the agenda is the re-launch of Nova’s AVOD services.

Voyo is in all countries within the CME group. Does it mean that you are not going to address Voyo in Romania, Slovenia and Bulgaria?

The thing is that in the Czech Republic, Slovakia and Romania we have launched a new platform while in other countries another platform is used. We want to integrate them in future but now, it is important to focus on the key markets and accelerate Voyo’s progress on them. And after that we will focus on other states. However, this does not mean that in other countries Voyo will not develop, we will just pay special attention to the Czech Republic and Slovakia.

It is interesting that already in 2012 when Voyo was launched Nova had a rather ambitious goal in the number of subscribers it wanted to win. At that time, about thirty thousand subscribers were attracted and then the group’s focus moved, Voyo support subsided and the number of subscribers was not growing.

It is true that the number of subscribers was constant in principle. But there was a change last year when the number doubled. In general I think that Voyo was introduced ahead of its time in 2012. In terms of development, it was an absolutely appropriate project but it was launched much earlier than people were ready and willing to pay for video services. Now the situation is different. Penetration of the high-speed internet and Neflix-like global players’ activities were of help. In order to make progress, we will have to double the number of Voyo subscribers every year.

Is it realistic to achieve a million subscribers in the Czech Republic and Slovakia in aggregate within 5 years?

If I were to answer this question half a year ago, I would have said that it was probably not realistic. Now I have been inside for a couple of weeks and can see great willingness and enthusiasm of CME and Nova to invest a considerable amount of money into the development of Voyo – both into content and marketing. We have a sophisticated strategy and a team that wants to move Voyo up. Seen from this angle, this goal makes sense and within five years, we could achieve one million subscribers in both markets. The market development also plays into our hands with Czech users learning to use paid services more and more. This makes the task easier.

On the other hand, with the development of video services including those provided by global players the market gets more crowded and less space is left.

Global competitors may benefit from economies of scale – they shoot at a large cost but their expenses may be covered by offering their products on global markets. We are playing on a substantially smaller playfield. Our big investments are incomparably lower than those of the global players. But I estimate that in our market, the theory of three may apply under which on any reasonably big market three players may coexist having a chance of a profitable life. I am convinced that Nova as a major producer of Czech content has a right to be among those three. It is the only firm that will provide professional and local content. Apart from Netflix, which has made significant progress in the pandemic, Disney+ will win its way in the local market as the second most important player in my opinion. I believe that if we do our job correctly and continue consistently we should be the third player to join Neflix and Disney+.

There are also other two strong local players – Česká televize, which is preparing a new form of iVysílání.cz, and the Prima group where you participated in the development of digital media in previous years including the development of the key platform iPrima.cz.

In the previous question, I was namely talking about prepaid video services (SVOD). But it is true that in order to achieve the required scale, a paid video library will naturally compete with AVOD services that are available free of charge. We thus have to show that our offering is substantially better than that available for free. In general, we want to attract people’s attention. We will fight for it not only with AVOD services but also with linear TV, Spotify and other services, so the battlefield is rather big.

In a meeting with journalists, CME’s CEO Didier Stoessel and the Programming Director, Silvia Majeská, have outlined Voyo’s strategy. How will you implement it?

There is much to build on, Voyo has become a famous brand over the nine years of its existence. We should considerably increase user experience, which should be data-driven and should adjust to specific users. This means for example offering content that the user will most likely want to watch. Users must receive sufficient amount of content through the best possible user interface. We will carefully monitor the metrics of time spent, which expresses satisfaction with the content offered. In terms of content we must offer the best shows of our own local production. This can differentiate us. It is unlikely to make some interesting acquisitions. Global players are building their own AVOD or SVOD services and withdrawing their own production from all potential competitors. Disney is withdrawing its shows from TV and Netflix and keeps them for itself and the same applies to other players. I don’t expect to make any strong acquisition within five years when the market pattern will start changing again. We thus have to have strong local content.

How would you like to expand Voyo’s content?

Already this year, we are planning to introduce miniseries that will be on Voyo only and will not be on TV. We are planning a new reality show, Love Island, that will be produced primarily for Voyo. We continue with previews of our original series that work well. But we cannot build just on them. This year’s investments will be relatively significant and next year they should be even several times higher and we will go on this way. We have addressed a number of local productions that should make series for us so that we can offer our viewers a new series every month. The view of the life cycle of content that is produced here has changed in the group. So far, an original series has been shown on TV and then placed on the internet on NovaPlus.cz. Before showing it on TV, a preview is offered in advance on Voyo. In the future, premium content will be produced primarily for Voyo. It’s the same as when a film is released in the cinema. First, it is shown in the cinema and only then it is on TV. Therefore, we want the most exclusive production to be on Voyo. After a year and a half or two years it will go to TV screens and from there to the AVOD service as a catch up for a week or two and then it will go back to Voyo to the full archive. This should help us invest effectively in the local content.

It was mentioned several times that Voyo’s development will require considerable investments and that CME has them ready for this purpose. How big are these investments?

Unfortunately, I cannot comment on this.

What will be the core of your effort to make Voyo more user friendly for its users?

Voyo has undergone a substantial re-launch recently, the service has been redesigned and I think it was done appropriately. But we will work on certain details so that, for example, users do not have to click several times before they get to what they want to watch. We want to offer them content based on our knowledge of their preferences and make the path to starting the video as short as possible. The longer they will search something or think the higher is the risk that they will leave. These details should lead to a notable improvement of the service.

If we take into consideration the Nova group’s five year goal to significantly expand the number of Voyo subscribers and if the plans are implemented, the paid services will generate much higher yield. This would result in a different pattern of revenues from advertising and paid services of the entire group. Is it possible to outline how strong digital should be within the Nova group in terms of revenues?

In the long-term I can imagine that income from users and from advertising should be balanced. It is in line with the general market development. Income from advertising will not skyrocket but income from users may rise considerably, which may be a large source of money for the group.

Apart from Voyo, which is paid, Nova has the Nova.cz and Nova Plus.cz web sites where videos are available for free. You have mentioned that you will address AVOD services as well this year. What will be their profile?

Our goal is to make our AVOD services more clear and simple. Nova.cz works as a link site from which users go to NovaPlus.cz. This is not user friendly in my opinion. There are too many brands, my concept is simpler, we should build a single Nova.cz brand. This should be another digital channel of TV Nova allowing users to watch what they haven’t seen on TV for some reason. Long-form videos should be the core of this service. Nova Plus is now focused a lot on bonus materials and articles. But what users want the most are long-form videos that are on TV. That’s why I want to change the logic of the AVOD service so that it focuses more on entire episodes that will be supplemented by bonus materials.

Wouldn’t it be better for Voyo and its development to place entire episodes to Voyo only?

For Voyo development, this would be the simplest and cleanest solution. But video advertising generates not negligible amounts in Nova. If we are investing massively in Voyo we cannot cut off such a big source of income. SVOD will now be in our focus instead of AVOD. The primary portion of our ideas, sources and marketing is directed at SVOD. But we want to keep AVOD as well because it works well for our advertisers. The service just should be fine-tuned and cleaned to work even better.

For some time, we can watch previews of original TV series on Voyo. Do they work well as a source of traffic?

They do, definitely. It is one of the largest attractions. With new subscribers, they form at least half of their first visit. In the total rating, previews represent tens of percent. It is an important element of Voyo’s offer and the easiest way to lure viewers to a paid service. As I have already said, we cannot build on previews only, we have to expand Voyo to include shows that were not on TV.

Do you consider a Voyo subscription price different from the existing CZK 159 per month?

The price has been continuously tested and it seems to us that it has been determined correctly. We will see what to do next. Now our priority is to enlist as many subscribers as possible. Profitability comes second and possible new packages may be considered later.

So Nova.cz should be the key pillar in the AVOD offering and Voyo.cz should be key in the SVOD offering. Is it realistic to consider development of websites connected to the thematic stations of the Nova group? Unlike its competitors, Nova does not have any such websites.

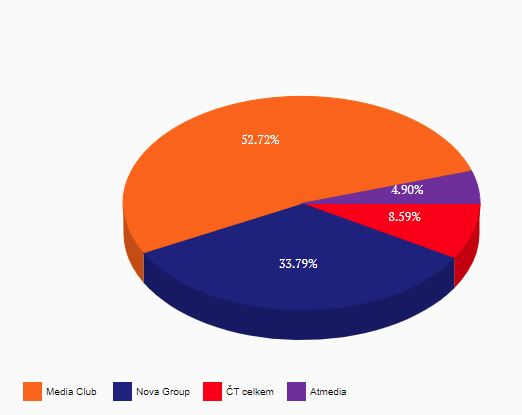

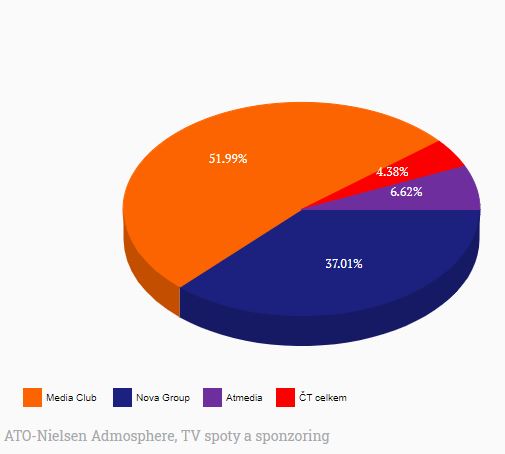

We are not thinking about this. These websites had their purpose when it was possible to generate interesting income from display advertising. But now this advertising makes less than a third of digital income for TV players. On the contrary, video advertising represents a large portion, which is key to us. Our goal is our AVOD service capable of concentrating content of all of these stations.

When will the TN.cz website be introduced in its new design?

We want to be able to launch the new design of TN.cz this year, we have just started working on it. The new design of TN.cz should be more connected with TV News and should be its extension.

The last question relates to HbbTV where Nova has not been too active. Will this change?

We definitely plan a more significant development of HbbTV but now we concentrate on three basic issues that I have described – Voyo, TN.cz and AVOD. But I perceive the red button as the easiest way to increased inventory. Its conversion from linear broadcasting is also very good as it is easy to use. We know that we should work on HbbTV. I would be satisfied if we make at least a new design of the entry page to the red button world and launch Voyo’s version for HbbTV.

Daniel Grunt, Head of Digital, CME

He started managing digital activities of CME in March 2021. At the same time, he became the New Media and Diversification Director of TV Nova. From 2012 to spring 2020, he was the New Media Director of FTV Prima. Before joining Prima, he led new media in the former publishing house Sanoma Media Praha, where he worked for a year and a half. Before that, he managed all internet activities of TV Nova for more than two years. He was the Marketing and Product Director of the internet portal Centrum.cz. He also worked as a Multimedia Manager in Nokia Czech Republic.

Source: mediaguru.cz