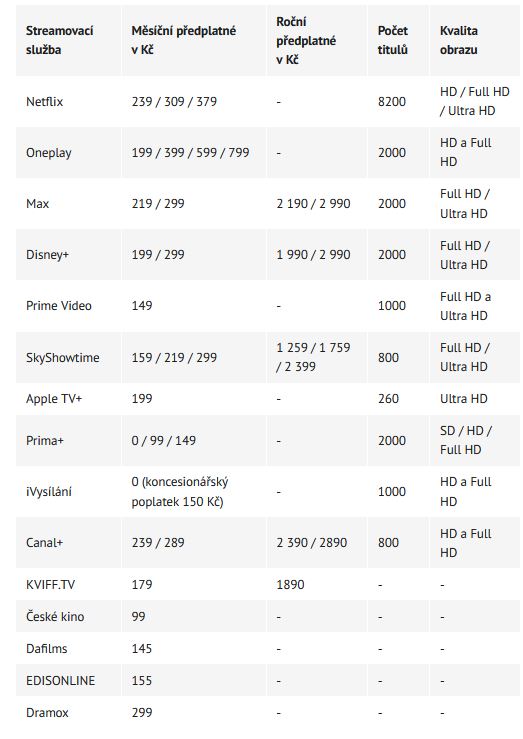

The merger of Voyo and O2 TV is a big change on the Czech market, which will also affect the price. After last year’s price increase for Netflix, Max, SkyShowtime and Disney+, this year the payment terms are also changing for Amazon Prime Video. Max, on the other hand, is adjusting its tariff for long-term customers. It is therefore increasingly important for users to actively manage their subscriptions, which can save them thousands of crowns a year. The Diary’s overview can help with platform selection.

Oneplay

The largest Czech streaming platform Voyo is closing together with another giant, O2 TV. However, a joint project called Oneplay will be created. The new product will be available in the Czech Republic from March 10 and will offer four subscription options. The basic one called Komfort costs CZK 199 per month and will offer over two thousand movies and 55 TV channels. Viewing is limited to one device.

The film library is also available in other subscription options. The Extra Entertainment package starts at CZK 399 and includes 100 TV channels, several of which are aimed primarily at family viewing. Sports enthusiasts can get Extra Sport for 599 crowns, which has 90 channels, but mainly specialised in sports. For the highest variant, Maximum, users will pay 799 crowns and will have 140 TV channels available and the option to watch on up to three devices.

Czech dubbing for many movies and series and TV broadcasts is still expected to be the biggest advantage. It is also possible to watch TV recordings.

Almost one million Voyo customers will have their subscriptions automatically transferred to the new Oneplay service, specifically the Komfort package. O2 TV users will get offers for the change. For all of them, their set logins and passwords will remain. One Oneplay account can then be shared on up to three devices.

Price: 199 – 799 CZK per month

Number of available titles: over 2000

Current picks: Studna, Bachelor, broadcasts of prestigious Czech and world sports competitions

Prime Video

Amazon has also gotten more expensive, yet it is still the cheapest service among the big productions. The monthly subscription fee has increased from the current 79 to 149 crowns as of 4 February. The reason for this is supposed to be investments in expanding the offer. The platform produces its own brands every year, it has also started broadcasting some live sports, allowing to watch matches of the prestigious American leagues NFL (American football), MLB (baseball) and NBA (basketball). However, the sport is not yet available in the Czech Republic.

Still, the subscription allows simultaneous viewing on up to three devices in Full HD or Ultra HD picture quality with surround sound and Dolby Atmos support. Twenty-five titles can also be downloaded, and up to six profiles can be created on the account. There is also the benefit of a seven-day trial, frequent Amazon digital store customers can get a thirty-day trial as part of promotions. However, Czech language support is still very limited.

Price: 149 CZK per month

Number of available titles: over 1000

Current picks: House of David, Bráchové, Banda (The Boys), Secret Level, Fallout

Netflix

Netflix is investing in sports, making it possible to watch documentary series and live broadcasts of industries particularly popular in the US, such as American football and combat sports. While the service has become more expensive in America, the price in the Czech Republic has so far remained the same since last autumn.

The basic subscription costs CZK 239 per month and allows HD quality viewing on one device. The Standard tariff is priced at CZK 309 and makes available Full HD quality videos that can be watched on two devices simultaneously, this also applies to downloads. This is the most cost-effective and sufficient option for a smaller family or undemanding users. The most expensive Premium costs 379 crowns, unlocks Ultra HD (4K) resolution, HDR and surround sound support as well as Dolby Atmos. You can watch content on up to four devices at the same time. You can download movies or series for offline mode on up to six. To share an account with people outside the household, an extra 99 crowns is required for each user who logs in with their own email address.

Each account can have up to five profiles. The content with Czech dubbing is also improving every year thanks to a larger selection of Czech films and series. More than half of the shows have at least subtitles. A bonus for subscribers is a mobile app with mobile games.

Price: 239 – 379 Kč per month, account sharing outside household 99 CZK per month

Number of available titles: over 8200

Current picks: Hra na Oliheň 2, Kdysi dávno v Americe, Návrat do akce, Stranger Things

Max

The service includes a portfolio of brands from HBO, DC, Cartoon Network, Discovery+, TLC, Adult Swim, and CNN, which means a significant selection of movies, series, shows, and documentaries. Eurosport sports channels can be watched at an additional cost.

The service offers two tariffs. The standard for CZK 219 per month, or CZK 2,190 per year, makes it possible to watch Full HD videos on up to two devices simultaneously and thirty items can be downloaded. Premium is 80 crowns a month more expensive, or 800 crowns a year, and allows up to four devices to watch content in 4K UHD quality with Dolby Atmos sound at the same time, plus it allows up to one hundred items to be downloaded. Both options are ad-free. The sports package can be added for CZK 70 in both cases. With an annual subscription you save 33 percent.

More than half of the content is offered with Czech dubbing, most of it has at least subtitles. There are also a number of Czech works. It is possible to have up to five profiles on one account.

However, as of March 24, the plan is changing for users who subscribed to the previous HBO Max platform and thus received the transitional Legacy plan with a 33 percent lifetime discount, allowing you to watch videos on three devices even in 4K quality. This will change to the Standard package, which means a drop in the number of active devices and playback quality. The price and lifetime discount will remain unless there are further tariff increases.

Price: 219 – 299 CZK per month, or 2 190 – 2 990 CZK per year, Sport for an additional 70 CZK per month

Number of available titles: over 2000

Current picks: Tučňák, Duna, Proroctví, Bílý lotus, Urgent, The Last of Us 2

Disney+

The platform saw some significant changes last year, so only content changes are planned for this year so far. The portfolio of Disney, Marvel, Star Wars, Pixar, and National Geographic brands continues to grow with new movies, series, and shows that users can watch by choosing one of two plans. Still the most convenient platform for kids, about half of the titles have Czech dubbing or most have subtitles.

The cheaper Standard offers videos in Full HD for up to two devices running simultaneously and with 5.1 sound quality. The price is CZK 199 per month, or CZK 1,990 per year. For more demanding users, the Premium version is priced at 299 crowns per month, or 2,990 crowns per year. Viewing is then possible on up to four devices in Ultra HD resolution with HDR and Dolby Atmos support. Both options are ad-free and allow downloading to up to ten devices.

To add people outside the household, an additional fee of 119 crowns is required for each user who creates their own profile and has streaming available on only one device.

Price: 199 – 299 CZK per month, 1990 – 2990 CZK per year, account sharing 119 CZK per month

Number of available titles: over 2000

Current picks: Whiskey s ledem, Deadpool & Wolverine, Husí kůže: Zmizení, Star Wars: The Flying Squad

SkyShowtime

After last year’s changes, nothing has changed for SkyShowtime yet. People can choose the cheapest option, Standard with ads for 159 crowns a month, or 1,259 crowns a year, which allows you to watch Full HD videos on one device. The higher ad-free Standard version is priced at 219 crowns a month, or 1,759 crowns a year, and also provides watching Full HD videos on up to two devices, as well as being able to download thirty files. The premium package, which allows viewing content in Ultra HD resolution simultaneously on up to five devices and allows downloading one hundred titles, costs CZK 299 per month, or CZK 2,399 per year.

The advantage of the platform is that most titles have Czech dubbing and subtitles. However, there are not many Czech programmes. It is also a fact that the available films and series, with a few exceptions, could be seen on TV. However, unique productions, especially series, have increased significantly in the last year.

Price: 159 – 299 CZK per month, 1 259 – 2 399 CZK per year

Number of available titles: over 800

Current picks: Dexter: Original Sin, Sweetpea, Landman, Dostoyevsky

Apple TV+

On a less prominent platform, it is possible to watch mainly exclusive series and films, moreover, in the highest possible quality, i.e. 4K with HDR, surround sound and Dolby Atmos support. The price remains 199 crowns per month. However, the content is usually without Czech dubbing and only subtitles are available.

The account can be shared with up to five people in the so-called family sharing, which can be joined by anyone with an Apple ID. Downloads for offline viewing are unlimited. You can try the platform for seven days for free.

Apple device owners can also get a TV+ subscription as part of Apple One, which includes all four of the brand’s subscription types (Music, iCloud+, Arcade). The monthly price is CZK 300. They have a free month to try it out on one device. Alternatively, three months after the purchase of an Apple product.

Price: 199 CZK per month

Number of titles available: 260

Current picks: Odloučení, Mythic Quest, Cíl číslo jedna, Terapie pravdou

Canal+

A lesser-known platform especially for fans of the English Premier League football and WTA tennis tournaments. The service also has its own video library of films and series.

A subscription for 239 crowns a month, or 2,390 crowns a year, allows you to play videos in HD to Full HD quality. The more expensive Komplet variant costs 289 crowns per month, or 2,890 crowns per year. In addition, it includes the Apple TV+ video library.

Price: 239 – 289 CZK per month, 2390 – 2890 CZK per year

Number of available titles: 800

Current Trailers: Premier League, WTA, Apple TV+ included

Prima+

The Czech platform will be especially appreciated by people looking for Czech films and series, or exclusive Prima TV productions. The platform also offers live and archive broadcasts of Prima TV.

The service is free with video and banner ads, the videos are in very outdated SD quality and users do not have access to unique Prima Originals shows or previews. This will only be made available by the Light package for 99 crowns per month, which will also halve the abundance of video ads, make banner ads disappear completely, and allow HD quality videos. To watch content in Full HD and completely ad-free, it is necessary to pay 149 crowns per month for the Premium plan.

Five profiles are possible in all variants, but simultaneous viewing is only available on two devices.

Price: 0 – 149 CZK per month

Number of available titles: 2000

Current picks: ZOO Nové začátky, Kamarádi, Zrádci

iBroadcast

The streaming platform under Czech Television is paid for by licence fees, so it’s seemingly free. Almost all content is with Czech dubbing, it is also possible to watch TV broadcasts and exclusive productions of the Czech Television. The content is mostly in HD, some titles are also in Full HD. There is no need to create an account and viewing is possible on an unlimited number of devices.

Price: free (TV licence fee 150 CZK)

Number of available titles: over 1000

Current picks: Děcko, Limity, Kroky vraha

Minor Services

KVIFF.TV is for fans of the Karlovy Vary Film Festival and independent film production, unlocked upon payment of a monthly fee of CZK 179, or an annual payment of CZK 1,890.

Czech Cinema lets you watch Czech films for 99 crowns a month. There are 14 days of free trials. However, the platform does not have an app available on TV.

Dafilms offers mainly documentaries and independent films, but also classics and can be watched for 145 crowns per month.

EDISONLINE collects mainly award-winning titles from the most important European film festivals, such as Cannes, Berlin or Venice, and costs 155 crowns per month.

Dramox is for theatre fans, who can watch online recordings of performances for 299 crowns a month.