Two CEOs of billion-dollar media houses at the same table: the head of Nova, Daniel Grunt (right), and his counterpart from Prima, Marek Singer, care about your entertainment and agree that we are living in the golden age of TV. Only this acronym no longer stands for television but for total video.

This meeting was special for at least two reasons. Both because of how rarely they sit down together so early, and because of how different it was from the previous occasion. “Do you know the last time we had breakfast together? After the conference in Lisbon. That’s when we almost went from dinner to breakfast, wasn’t it?” Daniel Grunt smiles.

And Marek Singer immediately counters, “We came straight from dinner!” Now we are in the centre of Prague, in the lounge of the Andaz hotel, where, as an allusion to one of the most famous TV shows in the Czech Republic, breakfast with Nova and Prima is taking place.

The two CEOs determine the mood of millions of Czechs: the content their stations and news websites serve, and how they are changing audiovisual production by investing heavily in so-called SVOD platforms.

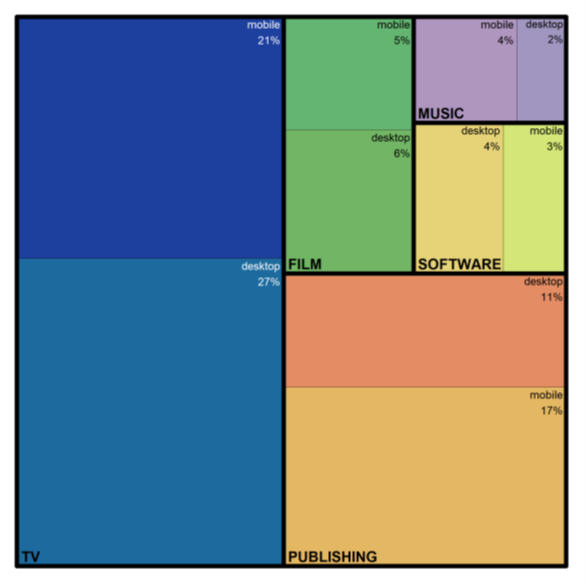

This acronym stands for Subscription Video on Demand, paid content available anytime, anywhere. That is what Netflix, HBO, Amazon and other global giants do. In the Czech Republic, the service is called Voyo in Nova and Prima+ in Prima.

Hundreds of millions of crowns are going there because television is not like it used to be and there is a need to keep attention in the online environment. And the two men are in charge.

“Are you asking whether the old TV model a decade or so ago was the simplest, therefore low-cost, and also amazingly profitable in times of properly set advertising prices? Well, of course it was. But that’s like saying horse-drawn railways were a good business model. It doesn’t matter now, it’s gone,” says Singer over a freshly served Eggs Benedict.

Singer has been running Prima for fifteen years and has built the former “third in the back” into a player who is fighting an equal battle with Nova in the field of commercial television. Grunt was promoted to the head of Nova last December, but he has also been in the media for a long time, having built up digital activities at Prima between 2012 and 2020.

This is also why there are no more hostile lightning bolts flying over double espresso and green tea as there were a decade ago. Back then, the bosses of the two biggest commercial TV stations in the Czech Republic, just in a different line-up, hated each other’s guts. The rivalry in business remains, but on a personal level both directors play fair.

“We meet and have discussions, it’s logical, we have the same types of media, we have to deal with similar things,” says Singer. That is why one of the central topics of the double interview is the planned increase in licence fees, which, according to Grunt and Singer, could fundamentally distort the market in favour of Česká televize (ČT, Czech Television).

Have the CEOs of rival commercial TV groups become friends? How long have you known each other?

Marek Singer: Dan and I have been through a lot, we know each other really well.

Daniel Grunt: I think of it like going to a basketball game with your friends. I always want to win there, then we go for a beer together.

MS: Exactly. When we go out for a beer, it’s different from looking at the figures. I don’t picture Dan behind them. (laugh)

Anyway, such a human relationship between the CEOs of Nova and Prima is a change, isn’t it?

MS: It helps if people have known each other for 12 years. It’s easier to discuss various topics, and the truth is that there are many. It’s not just about television, the field where we meet is wider. We don’t think of ourselves as television, we think of ourselves as media houses, which is why we are talking more and more about regulatory issues that need to be addressed and ideally coordinated. Even the state authorities always tell us to come as the Association of Commercial Television with one common solution, not three. From what I remember, when I joined the firm, there really wasn’t much contact between my predecessor and Dan’s predecessor at the time. We know each other, so communication is easier, and our discussion is to the point.

DG: And it’s also about some refinement and education of the market. A decade or so ago, the push and pull between the digital and TV worlds began, where suddenly apples and pears were being compared. One of the reasons to start the Association of Commercial Television (AKTV) was to show how the metrics differ. That a started stream does not equal average viewership on TV and other things.

MS: Which still not many people know. That’s why we’ve been like this for so long. Not that we text and call each other every day, but when something happens, we keep in touch. We fight for the interests of the commercial media, our association is the younger sibling of the ATO (Association of Television Organisations, which includes ČT). Because sometimes our interests are different, as we see right now.

You have known each other for many years, how do you get on with the new head of ČT, Petr Souček?

MS: We don’t know each other at all yet, I didn’t go to Brno much. We have an appointment.

DG: We had a short lunch to meet each other, but that was a meeting at a personal level.

ČT and licence fees will be discussed soon, but before that: how is your business doing? Times are difficult not only in the media, is this also true for TV?

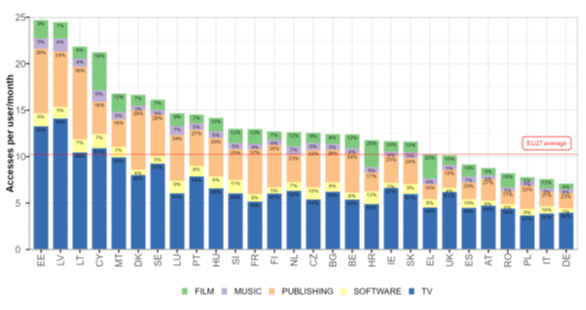

MS: It depends on which country you’re looking at. Yes, it’s a relatively healthy, growing business here. If you cross the German border, it’s different.

DG: It’s also about the point of view. One thing is advertising money, and another is how people consume TV and premium video content. That’s been changing fundamentally and terribly fast in recent years. The big players in the west are flying from right to left. One day they call: nothing but SVOD. Next time they say SVOD is a mistake and everything needs to go back to TV, to cinema. Further development is a big question.

One thing is advertising money, and another is how people consume TV and premium video content.

Daniel Grunt

And where are advertisers moving?

DG: We need to adapt to how fundamentally modern technology will change the way people consume content. We both have SVOD services and linear content to go with it, we need to think about this so that we don’t “cannibalise” within one media house and instead have as much reach as possible. No one knows in advance what the right recipe is. TV advertising is the core of what still feeds us, and I believe it will be our main source of revenue for at least the rest of the decade. And I have to say that this year has been positive. It’s looking good.

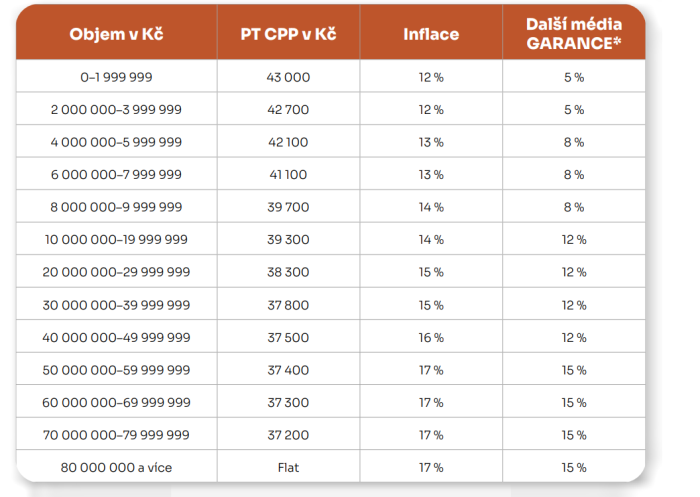

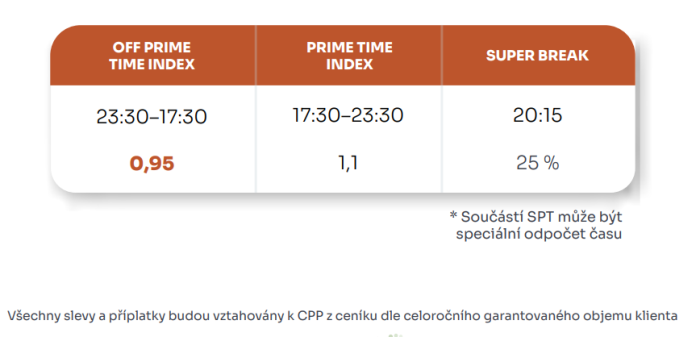

MS: Our capacity is filled up nicely. So much so that we’ve just announced that we want 22 percent inflation in advertising prices for next year. That’s the answer.

So your financial performance is growing?

DG: It is too early to assess the whole year, the two strongest months are ahead of us.

MS: That’s like asking a retailer how Christmas will turn out. It’s too early.

DG: But going into detail, year-to-date through September, we see growth in the single-digit percentages.

MS: So do we.

I guess the price of advertising will never go any lower, won’t it?

DG: Logically, no.

MS: It is a question of supply and demand. Television advertising is still a very effective tool in the Czech Republic to reach a lot of people quickly. We were catching up with the slump of 2008 and 2009, which is why I ‘love’ the simplification that ČT is poor, that it has been getting the same money for years – we lost thirty percent back then, and it has taken ten years to dig out of that. Yet each of us has a bigger viewership than ČT. But back to your question – yes, it looks like the advertisers have money and want to invest it.

From Strašnice [where Prima is seated] you cannot see Kavčí hory [Česká televize], but from Barrandov [Nova] you can. The forthcoming amendment regarding the increase in licence fees is expected to bring the public broadcaster up to CZK 1.8 billion a year more. And at breakfast with Nova and Prima, one can sense the disappointment, even annoyance, of the heads of the commercial stations.

“No one from the commercial entities was invited to discuss this, they even told us to our face: Don’t deal with this, it’s not on the agenda, we’re not going to deal with it in the government,” Grunt says. And Singer, in contrast to his usual quick cadence, is suddenly choosing his words more judiciously so as not to speak in emotional terms.

“We had a working group on the Czech Film Fund (SFK) for a year and everyone who just fleshed past the Fund was involved. It’s not that the ministry can’t do it, it can do it if it wants to. Here they have completely bypassed the entire market on purpose and prepared something that has absolutely no context.” They frequently talk about the lack of any conceptual model.

“When I look at it as a businessperson, I would first try to understand the problem, analyse it, figure out what actually needs to be done, see what impact it will have on the market – and based on that, come up with a model to solve it,” Grunt says.

And you don’t think that happened.

DG: Suddenly, the proposal comes with a blank cheque for up to 1.8 billion, which is in no way related to what ČT is supposed to do with it. Petr Dvořák has long talked about the fact that his budget lacks roughly CZK 300 to 500 million a year. So, you have a much smaller problem, you pour in huge amounts of money and there is no impact study prepared on what this will do to the entire media market. That is an approach that surprises me.

MS: Why does it bother us so much? ČT’s production capacity is something like 2.2 billion. Excluding news. They won’t add everything to their programming, but let’s say a billion crowns. I could build another ČT1 for a billion. Do we need it? That’s the question. Has anyone thought about what good it does? I realise that we probably need to add some money, Petr Dvořák talked about the fact that otherwise, he would have to start saving substantially, but almost two billion is different from 500 million.

What impact on the market do you expect?

DG: We’re already talking about the market being so saturated that creative professions can make a choice and it’s driving up the price. And another thing: If I’m sitting at ČT and I don’t have a clear instruction and somebody’s pushing me that they want a big share, I’m going to put the money into commercial formats, I’m going to buy more sports rights – things that I think are outside the scope of what ČT should logically be doing.

Is this a fundamental problem for you?

DG: We ask what they should do with the money and why there should be so much of it. I am convinced that it can skew the market quite substantially in favour of public television. Let us not forget that the proposal does not address the fact that they should not receive money from advertising or sponsorship, for example. What could happen is that a dominant position would be artificially created for ČT.

MS: But it’s not just TV, there’s also Český rozhlas (Czech Radio) and both have a strong online presence. That really has an impact on the whole market. On us, on you. There will be a state-subsidised medium, even if we call it public service – and a tax that will force us all to pay for a public service medium that has no defined requirements to fulfil. Well, that’s great!

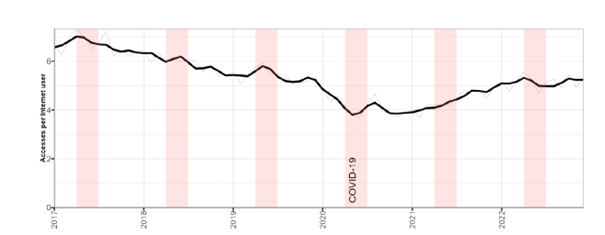

DG: The most common argument is that the fees have not increased for a long time; but look at the commercial entities. In 2009, all media took a brutal hit, there was another one in 2012, then Covid-19. Commercial entities had to deal with it, no one gave them more money. In terms of the amount of advertising, the TV market is only now returning to 2008 levels. And we have to streamline, look for other ways. I don’t know if this debate took place in ČT. I believe that Petr Dvořák as a manager has covered a lot of things, but is it really necessary to pour 1.8 billion into ČT now?

What do you think would make sense?

MS: I also don’t see what is effective and what is not in ČT. Petr Dvořák who was the CEO for twelve years was the best person to see this. He was asking for an extra CZK 300-500 million, and there was probably a reason and a logic to that. This is certainly a good starting position without anyone doing an in-depth analysis. And let’s do that analysis!

DG: Moreover, there is no rush, they have nearly two billion on their account, so it is time to take a good look at what ČT really needs and what to spend the money on. There’s no hysterical pressure that if it’s not done, TV will collapse.

MS: Other things don’t make sense to me either. For example, that they are going to target mainly the young, while in this country there is a large group of viewers that you and I don’t target at all, a net zero: people over 54 on Nova and over 69 on Prima. There’s free space. And ČT will invest in the young instead? And give the old people ČT3, which means the archive? That’s the essence of the whole discussion. Maybe 1.4 billion crowns are right. But what should we do with the money to provide a real public service?

Another competition, on the other hand, is already underway. And the commercial TV stations are coming out of it well. Forbes recently described the story of Michal Reitler, the biggest star among Czech creative producers, who moved from ČT to Voyo.

The ambitious video library aims to have one million subscribers in the Czech Republic and Slovakia by 2026, and as Grunt reveals, they have already exceeded 650,000. “Voyo has become a flypaper for talent,” the head of Nova says, describing how quality work, or even artwork, has long been created not just in Kavčí Hory [ČT].

Prima+’s plans are identical in this respect, although Singer admits that the competition has a head start. The proof is that the prestigious Serial Killer festival was dominated by a Czech work for the first time this year, the series Metoda Markovič: Hojer produced by Voyo.

“I’ve seen it, and it looks amazing, it deserves to be in a multinational platform,” says Grunt, and we are thus flexibly moving from the Czech market to the global one. In fact, Voyo and Prima+ are fighting other battles besides local competition. They are competing with Netflix and similar giants.

It has often been said that we are living through a golden age of television. Is that still true?

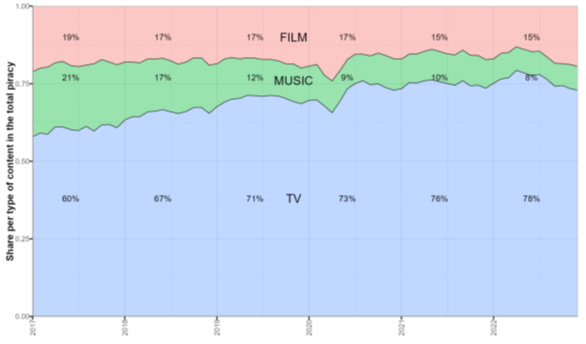

MS: I would put it another way. We are both part of the European association of commercial media houses and there is no longer any discussion about television as such. TV doesn’t mean television, it means total video. That’s what it’s about. The golden age of total video, I agree. The transformation is already underway and will take place everywhere, there’s just no telling what exactly it will look like.

DG: Total video, that’s right – it’s the golden age of quality video content. I don’t think there was ever that much of it.

MS: Certainly not in the Czech Republic.

DG: Nor in the whole world. All the big studios are going full speed ahead, except for the strike that is now going on in Hollywood. The big platforms have certainly helped, they’ve shown people that they can put more content on the market.

MS: It almost scares me as a traditionalist because people have to make time for this. And there are social media to add to the time spent on total video, which means lots of hours. That’s good news for us; whether it’s good news in general, I don’t know.

Do you have enough people for that content?

MS: The number of people is not growing as fast as the demand.

DG: I think you’ve hit on a fundamental problem. The demand is huge and it’s not just me, Marek and ČT that are filming, there are a lot of foreign productions being made here. The demand for quality creative professionals is extreme. Firstly, you have to get them – and secondly, you have to pay for them.

Are they motivated by making so-called quality TV?

DG: By being able to choose more, they logically go for projects that they enjoy more and have a nicer output. I can see it on Voyo. We give them free rein to showcase themselves and room to publicise it on our platform. We have started to bring in creators who haven’t worked with us before.

MS: Interesting new talents and fresh ideas are emerging. Let’s be realistic, it’s not going to happen that the whole nation wants to watch Czech House of Cards or Czech Fauda, you still have to have a broader portfolio. But the portfolio is more diverse today. And it’s moving up in quality.

DG: The Covid-19 period has made people more willing to pay. They’ve had more time, they’ve seen more, now they’re prepared to pay, and the quality has expanded as a result.

MS: It also made them watch. Suddenly, they have accepted things they wouldn’t have been willing to admit before, such as subtitles. They got a broader perspective.

That’s enough about global trends. We repeatedly hear that the key to success is being local.

DG: It is also a logical defence of local players against multinational platforms.

MS: And the question is whether that’s their business model. Stranger Things is a fantastic thing, but only for some people. Yet around the world. That’s the business model.

DG: That’s right. If one of us put this on prime-time TV, it would do next to nothing, our local shows would beat it.

MS: We tried Narcos, ČT tried House of Cards, the results were very bad. And logically – the people who wanted to see it had already seen it on Netflix. And the mainstream will say: That’s weird.

When does your series happen to be on Netflix, on Disney Plus or elsewhere?

MS: The question is whether we want it there. We’re competitors, so why help them with local content?

DG: Exactly. That’s why we invest so much money in quality local work, to differentiate ourselves and draw attention to ourselves. Yes, we can talk about the fact that the stuff we have for Voyo could be on Netflix or on a similar platform outside of Europe, outside of our region. That may happen in the future. As for quality, I think we are clearly there.

What about the so-called Czechflix, the big common domestic platform? Do you take it into consideration?

DG: Popular topic, isn’t it? Say what you think, Marek.

MS: Under certain circumstances, it would make sense. But I think if we go back to that, it’s going to take some time. At the moment, we all have our own plans for how to do it going forward, and we all feel we are able to replicate our success from linear TV in the Czech market for the time being. So, for me, Czechflix is not on the agenda.

DG: We are in a situation where all market players have to adapt to a rapidly changing environment. To discuss things together, and that makes you stop while you need to move forward quickly. Why is Voyo successful? Because it stepped in early and full force. And then there are a lot of practicalities. As much as Marek and I like each other, we’re competitors and it’s hard to fight for every percentage point in a linear environment and do a common platform on top of that.

In purely business terms, how crucial is it that you are owned by Czech capital? I mean PPF and GES GROUP?

DG: This is absolutely crucial for both of us. We are facing a period where we don’t know what will happen and we are trying to set the right path, so we need a long-term view and a patient investor or owner. The big platforms are jumping from right to left precisely because they have to keep presenting new stories to shareholders on a quarterly or semi-annual basis at investor calls, so they are flying to extremes. We don’t have to. It’s more important to build a long-term sustainable strategy. I can’t imagine doing it without those owners.

MS: I agree. And that’s why there will be further consolidation on the international front. Investor pressure will force them: when you don’t have your own story, you team up with someone. In New York, I’ve heard this from several CEOs of major US media houses. They said they had a strategy for three years at most and didn’t need it beyond that because someone else would own them.

How long do you have it for? And is it feasible?

MS: This is the right question, our reason is different. Leaving aside AI, the underlying trends are clear – but what is not predictable is the extent of those trends. We had a plan for how the adoption of paid services would go, but Covid-19 totally changed that. This is what you can’t predict. It’s about having a clear idea of what you want to do and being fast and flexible enough.

DG: I totally agree. It’s important to have a company set up so that your processes and organisational culture allow you to react very quickly to major changes. And you have to have a vision.

How do you do that?

MS: It’s hard to do! But we have to do it and want to do it to succeed.

DG: When I joined CME three years ago, Didier Stoessel launched a huge vision that Voyo would have a million subscribers in five years. I’m convinced that these visions are absolutely necessary to move the company fundamentally, otherwise you can’t change the way people work. You have to show the beacon that will make people do things differently. And then you need to have a cheerleader that convinces people that it can be done.

The system needs to be set up so that you identify and kill the bad things quickly and move on.

Daniel Grunt

What else is key?

DG: That you won’t run away. It’s better to set a strategy and keep going down that road, even if it is only eighty percent right, than to fly from side to side. I also see from the Voyo example that it’s better to stop worrying about leaks and be more open with people in the company so they understand the context and know why they should do something; then they’ll come up with a much better idea of how to do it. Next, have a clear focus on the most important things. And a culture of people not being afraid to make mistakes. That’s maybe the most important thing. That they are not punished for doing something new and it might fail – because otherwise they never do anything new. Rather, you need to set up the system so that you identify and kill the bad things quickly and move on.

MS: I totally agree, and I would add one thing: you need people in key positions who are hungry for success, who want to win. It sounds automatic, but especially in successful companies it is hard, people get used to success. The best general vision has to have some personification, look around the world: it’s either the founder or strong leadership. That’s the fourth element for me.

So no routinists?

MS: No, wait, you need those too, but you need them in the right place. You need to do a lot of routine things, but the leader won’t do those because he’ll get bored.

DG: You still need to have a stable core business that will fund you. You can’t “break it up” for the sake of new things.

Or “voyo it up”.

MS: That was good!

DG: I hope we didn’t voyo it up. (smile)

Source: forbes.cz