The ReDAM project, which aims to bring out-of-home TV and video audience measurement to the Czech market, is progressing according to plan. According to ATO’s Managing Director, Michal Jordan, the official launch is still scheduled for January 2026.

The Association of Television Organizations (ATO) is in the final preparation phase of the ReDAM project, which aims to deliver the first data on out-of-home TV viewership starting January 2026. According to Michal Jordan, ATO Managing Director, the planned schedule is being maintained. A key element is mobile measurement, with the panel gradually growing to the target size. The entire TV audience measurement system in the Czech Republic recently underwent an international audit, and the results confirmed the quality and relevance of the current PCEM project.

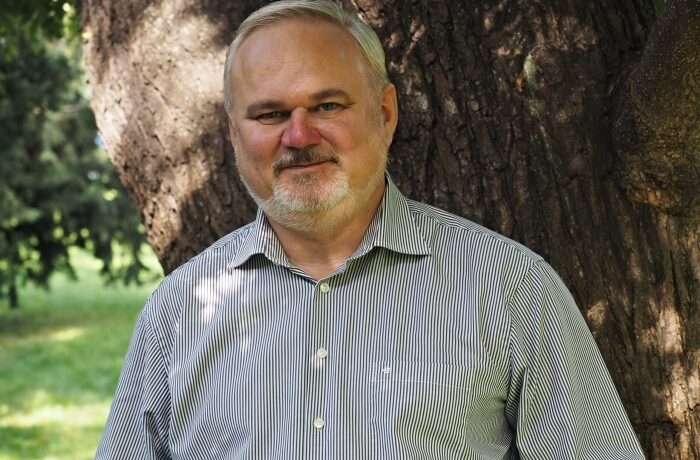

Details about the ReDAM project and other measurement plans in the Czech Republic are provided in an interview with ATO Managing Director Michal Jordan.

At what stage is the out-of-home audience measurement initiative, known as the ReDAM project? Are you managing to keep to the planned schedule to deliver the first combined data from January 2026?

The ReDAM project is currently on schedule, and the original goal of delivering combined data from January 2026 remains unchanged. All the implementers—ResSolution, the technology provider DCore, and Nielsen, which handles the fusion and merging of data—are working with maximum effort under the pressure of ambitious deadlines. I deliberately say “currently,” because anyone who has ever managed a similar project knows how complex the finalisation phase can be. However, we have no negative news and believe we will meet the planned schedule.

A key component of ReDAM is mobile measurement. How is the recruitment of panellists going so far, especially since you have set stricter rules than usual? Are you encountering any complications when approaching respondents?

Recruitment is generally difficult in any current research project, not just here. It is a global problem. However, I cannot give a more specific answer yet because we are still in the process of building the panel. The panel is not yet representative in all characteristics, and whether problems will arise in certain demographic groups during the final phase remains to be seen.

Are there already initial test results that might indicate the impact of out-of-home audience measurement on overall ratings?

Currently, our panel includes over 600 individuals, with a target size of 1,000. Since early August, we have received certain private outputs from the implementers, but we have handled these very cautiously. The panel is not yet fully representative and is still “too new” in terms of respondents’ acclimatisation.

The first figures from out-of-home measurement were relatively high and reached levels comparable to some similar international projects. However, it is important to expect that the results will still change. This is partly because we started in the summer, when there are generally more opportunities to watch TV outside the home, and partly because the distinction between small and large screens will only be implemented in the autumn. Additionally, ATO plans to only work with large screens in the official results. Therefore, in the autumn, we are preparing a workshop for PCEM data users where we will discuss all these issues in detail.

One of the common practical questions is at what time the new data will be available from January 2026. Is it already clear whether the distribution will be in the morning or in the afternoon?

Contractually agreed deadlines basically anticipate afternoon distribution. However, I am confident that all providers will do their best to ensure that the delay compared to the current situation is not too long. If we recall the introduction of the original people meters, data delivery times also gradually shortened until they reached their current format. I expect a similar development for the new system as well.

And I might add something a bit “against the grain”. If we say that the world of television and digital video is becoming dramatically more complex, and that we want the largest possible data samples and the most robust methodologies, we have to accept that processing such data takes a bit longer. It’s the price we pay for the complexity we live in today.

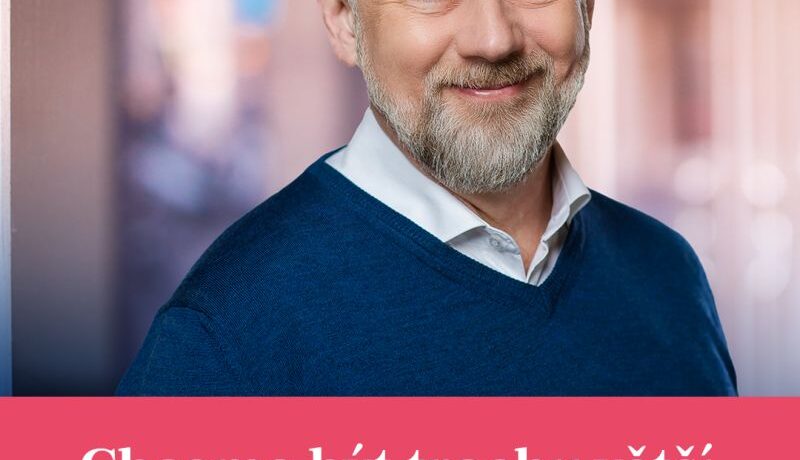

The contractually set deadlines basically anticipate afternoon distribution. However, I am confident that all the providers will do their best to ensure that the delay compared to the current situation is not too long.

Michal Jordan

If the ReDAM project successfully gets underway, what significance do you think it will have in ATO’s long-term strategy, which aims to gradually expand the project for measuring television and video content?

I would refer to the answer I gave earlier. Our vision is to add new components to the existing measurement system. Mobile measurement is one of these components, and what’s important about it is not just the actual measurement outside the home, but also a certain technological and methodological independence from the main project. I also mentioned AdCross, which I am convinced is only a matter of time before it becomes part of ATO’s official measurement, as well as RPD. These answers still hold true today, although some things are progressing more slowly than I initially expected.

Can you be more specific then? Are you planning to use RPD data?

We are intensively exploring various possibilities. In neighbouring Austria, an interesting project has emerged, which we are closely monitoring. Simply put, it involves modelling a large data source through a panel, with calculations performed on the resulting ‘synthetic’ data source. Crucially, this is a solution that the local TV market developed independently, without multinational platforms. It is inspirational for us; we are in communication with our Austrian colleagues, but so far, no decision has been made. My conviction that the integration of large data samples is essential in the future remains unchanged. Equally unchanged is the fact that the path to achieving this is significantly more complicated than it might seem at first glance.

What methodological or technological challenges do you see in the current measurement? Is it, for example, distinguishing by screen size, type of environment, or preventing duplicates?

I consider overall complexity to be the greatest technological challenge. When only linear television was available, ‘measuring TV’ was significantly simpler and less costly. Today, it is necessary to cover a whole range of new technologies and ways of consuming content. Each such extension comes with a cost, and for each one, it is necessary to define how to finance it and why it is needed. A typical example is the measurement of smart TV applications, which are now part of the system, whereas a few years ago, such technology did not exist at all.

In the past, ATO mentioned an interest in expanding measurement to digital platforms and streaming services. In this regard, in which direction are you heading, and is it realistic to include global players like YouTube or Facebook?

I would divide the question into two parts. When it comes to local streaming services or VOD platforms, ATO is definitely interested, and this is also related to AdCross. However, regarding global platforms like YouTube or Facebook, we do not expect that a solution can be found solely within the Czech market. We are part of international organisations and observe how this issue is being addressed in larger markets. And we see that it is still quite difficult. Over time, a European or global solution may emerge, which we would then adopt. The purpose of ATO is primarily to support the development of the local market, and therefore, entities wishing to be monetised through official measurement must actively participate in its development.

When it comes to global platforms like YouTube or Facebook, we do not expect that a solution can be found solely within the Czech market.

Michal Jordan

How should the Czech measurement system keep pace with international developments? Do you see room for deeper cooperation with foreign organisations or inspiration from models in other markets?

I might say something different than expected. On the side of multinational research players, I see few products that would truly be suitable for medium-sized markets like ours. I’ve already mentioned the Austrian example, but even our mobile measurement project uses local technologies from ResSolution and DCore, AdCross runs on a platform developed specifically for the Czech market, the software has Czech origins, and the data fusion is tailor-made. That doesn’t mean we don’t want to draw inspiration from abroad, but sometimes it’s more complicated. Some things we simply have to solve on our own.

Is it realistic that in the future, the ATO membership base could expand to include representatives of digital platforms or new players on the market?

I’m not aware of any major changes at the moment. However, ATO is continuously working on finding the most effective internal decision-making mechanisms. In general, I perceive the Czech market as very rational and cooperative, which I consider great news.

ATO underwent two international audits this year. Could you please explain their results and significance?

At the end of last year, CESP conducted a test of the DCore technology, which we decided to use in the ReDAM project. This was a necessary condition for us before giving the project the green light — since it was a new technology not yet used anywhere else, the independent risk audit significantly reduced potential risks. The results were very good, which is evident from the fact that the project was approved.

In the spring and summer of 2025, a second audit took place, this time focused on the “main” PCEM project. We are currently in the third year of a five-year cycle and need to decide how to proceed. The audit results were positive from ATO’s perspective; it confirmed that the project is relevant and that we need not worry about its quality. I was personally surprised by the scope and depth of the audit, as in certain areas, it went into much greater detail than I have ever experienced. I would recommend such a thorough “X-ray” examination to every research project.

The audit was also related to the question of whether ATO will exercise the option to extend the PCEM project into the years 2028–2030. The audit results allow for the use of this option, so the decision will be up to the ATO members, and it will come relatively soon. If the option is not exercised, alternative solutions will need to be sought. In any case, even within the current cycles, we have the possibility to further develop the project, as exemplified by ReDAM.

I was personally surprised by the scope and depth of the audit, as in certain areas, it went into much greater detail than I have ever experienced. I would recommend such a thorough “X-ray” examination to every research project.

Michal Jordan

If the ATO members decide not to exercise the option, what would that mean, and how would you proceed regarding the next phase of the PCEM project?

Exercising the option is just one of the possibilities we have. We can modify the business agreement with the current supplier or consider some systemic changes. ATO has plenty of information and business contacts with practically all relevant entities (both local and international) that could potentially provide parts of a new solution. In most cases, we even know the current prices. Therefore, I believe we have a fairly comfortable position to consider where we might take the measurement next and how.

My answer does not anticipate or favour any particular option. We are satisfied with the current project, but if we have to consider time horizons around the year 2030, we should make decisions with the greatest possible knowledge of all the ‘possible’ measurement options, as well as the technological and commercial development of the market.

Source: mediaguru.cz